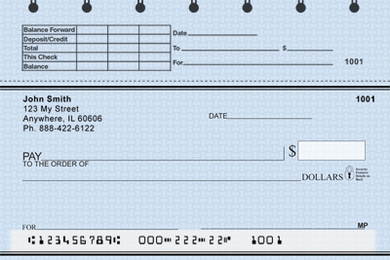

Are you a small business owner looking for an efficient way to keep track of your transactions? Look no further than register checks! These handy little forms are a must-have for any business, ensuring accuracy and organization in your day-to-day operations. In this post, we’ll explore the benefits of using this accounting paperwork, offer tips on choosing the right ones for your business, discuss how to use them effectively, and highlight their security features. Get ready to take control of your finances with top register checks!

Benefits of Using Register Checks for Small Businesses

When it comes to financial management, small firms confront certain challenges. Keeping track of sales, expenses, and inventory can quickly become overwhelming without the right tools in place. That’s where this accounting paperwork comes in handy. These specialized forms provide numerous benefits for small business owners, helping them stay organized and efficient.

One major advantage of using these checks is that they allow for accurate record keeping. With each transaction recorded on a separate form, you can easily track your daily sales and keep a detailed log of all your transactions. This not only helps with balancing your books at the end of the day but also provides valuable information for analyzing your business trends and making informed decisions.

This accounting paperwork makes it easier to detect any discrepancies or errors in your cash flow. By comparing the amount on each check with the corresponding entry in your accounting system, you can quickly identify any inconsistencies and take swift action to rectify them.

It also offers enhanced security features compared to regular paper receipts. Many come equipped with anti-fraud measures such as watermarks, microprinting, and heat-sensitive ink that help prevent counterfeiting or tampering.

Using these checks demonstrates professionalism to customers by providing them with clear documentation of their purchases. The professional appearance lends credibility to your business while also instilling confidence in customers knowing that their transactions are being accurately recorded.

How to Choose the Top Register Checks for Your Business

When it comes to choosing this check for your business, there are a few factors to consider. First and foremost, you need to think about the size and type of checks that will work best for your needs. For small businesses, single or duplicate checks are usually sufficient, while larger businesses may require triplicate or even quadruplicate options.

Another important consideration is the design of this check. You want something that not only looks professional but also reflects your brand identity. Many companies offer customizable options where you can add your logo and company information.

In addition to design, security features should also be taken into account. It often comes with built-in security measures such as watermarks, microprinting, and heat-sensitive ink. These features help protect against fraud and counterfeiting.

Cost is another factor to keep in mind when selecting this check. While it’s important not to skimp on quality, it’s also essential to find a supplier who offers competitive pricing. Consider shopping around and comparing prices from different vendors before making a decision.

Tips for Using Top Register Checks Effectively

- Keep them organized: One of the key tips for using these checks effectively is to keep them organized. Make sure you have a designated place to store your checks, such as a secure drawer or folder. This will help prevent loss or misplacement and make it easier to access them when needed.

- Use sequential numbering: To stay organized and track your transactions accurately, use this check with sequential numbering. This ensures that each check has a unique identifier, making it easier to reconcile your records later on.

- Double-check before printing: Before printing this check, double-check all the information entered, including the payee name, amount, and any additional details like memo lines or invoice numbers. This can help avoid costly errors and save you time in correcting mistakes.

- Reconcile regularly: As part of good financial management practices, reconcile this check regularly with your bank statements or accounting software. This helps identify any discrepancies or fraudulent activity early on and ensures accurate record-keeping.

- Store securely: When not in use, store unused accounting paperwork in a secure location to protect them from theft or unauthorized use. Consider investing in tamper-evident envelopes or using locked cabinets for added security.

- Train employees on proper usage: If you have employees who handle these checks on behalf of the business, provide training on how to properly fill out and document transactions using these checks. This can minimize errors and ensure consistency across all transactions.

Security Features of Top Register Checks

When it comes to running a small business, security is always a top priority. This includes ensuring the safety and protection of your financial transactions. Enter top register checks – these handy tools not only help you keep track of your sales and expenses but also come equipped with various security features.

One important security feature to look for in this accounting paperwork is the use of microprinting. This involves printing tiny text or images that are nearly impossible to replicate accurately. By incorporating microprinting into your accounting paperwork, you can deter potential fraudsters who may try to create counterfeit copies.

Another essential security feature is the use of watermarks. These translucent marks are embedded into the paper during manufacturing and can be seen when held up against light. Watermarks add an extra layer of protection as they cannot be easily copied or reproduced.

Additionally, it includes chemical reactive ink technology. This type of ink contains special chemicals that react when exposed to certain substances like bleach or solvents commonly used in check washing attempts. The reaction creates visible signs on the check, alerting you to any tampering.

Summary

Top register checks are an essential tool for small business owners. They offer a range of benefits, including accurate record-keeping, easy accounting integration, and increased security measures. When choosing this check for your business, consider factors such as compatibility with your point-of-sale system, customization options, and cost-effectiveness. Additionally, follow these tips to use this check effectively: keep track of all transactions in real-time, reconcile your accounts regularly, and take advantage of the security features offered by this check.

Investing in high-quality accounting paperwork ensures that you have a reliable means of tracking your sales and managing your finances. With their ability to streamline processes and provide peace of mind when it comes to financial security, these checks are truly a must-have for any small business owner. So don’t hesitate – start using these checks today and experience the benefits they bring to your business!